The automobile market is bettering however issues are nonetheless tough for many consumers and naturally superstar “finance specialists” are completely happy to dole out their traditional, largely unhelpful, recommendation for folk struggling to search out an reasonably priced trip. To take one of many newest examples, Suze Orman has six car-buying suggestions, a few of that are so contradictory you’ll in all probability simply find yourself taking the bus.

Suze Orman, like Dave Ramsey, makes their cash giving funds recommendation to people that always discover themselves in dangerous conditions relating to spending and debt. There are quite a lot of Individuals which can be frankly actually dangerous at math and will use some monetary self-discipline. Nevertheless, relating to shopping for a automobile, these superstar methods can typically find yourself being impractical and unhelpful.

Not too long ago, Yahoo! Finance revealed “Suze Orman’s Prime 6 Automobile-Shopping for Ideas To Assist You Save Extra,” and whereas many of the recommendation appears sound on the floor, when you truly dig into the realities of the market, executing this plan is a little more difficult.

First I’ll tackle what Orman will get proper. She says to spice up your credit score rating by paying down debt as a result of in case your FICO is over 700 you have got one of the best likelihood of getting the bottom charges attainable. That being stated, due to the way in which the credit score system is designed, the period of time it takes in your rating to enhance by 20 or 30 factors is a lot better than the time it takes to drop. In case you are a kind of individuals with a FICO within the low to mid 600s, it might be months and even years earlier than you recover from that 700 threshold.

She additionally advises to buy your loans round and take a look at native credit score unions for financing. That is wonderful recommendation and also you by no means need to be on the mercy of regardless of the supplier goes to give you, particularly since present rates of interest have been on the upper aspect. Beyond that, issues begin to come off the rails.

Orman opens with this –

“For starters, we have to get on the identical web page: A automobile is the worst funding,” said Orman on her web site. “Why? As a result of from the second you drive it off the lot it loses worth. You’ll by no means recoup what you paid for the automobile while you ultimately promote it. Received it? Good.”

The concept a automobile is an “funding” in any respect is the core drawback of quite a lot of this recommendation. Automobiles, for essentially the most half, will not be investments. The higher technique to view them is as home equipment or maybe “mandatory bills,” and also you don’t see Orman or Ramsey suggesting you purchase the most affordable fridge you possibly can from Craiglist.

Utilizing that perspective shift is vital to determining the way to handle this buy. Orman’s suggestions, on this regard, aren’t so useful. She says to “Purchase on a budget” and that “your aim needs to be to purchase the least costly automobile. Interval.” However she additionally says to purchase a “gently used” automobile that’s 2-3 years previous. Perhaps Orman merely hasn’t appeared on the market lately, however 2- to 3-year-old vehicles, today, will not be “low-cost.”

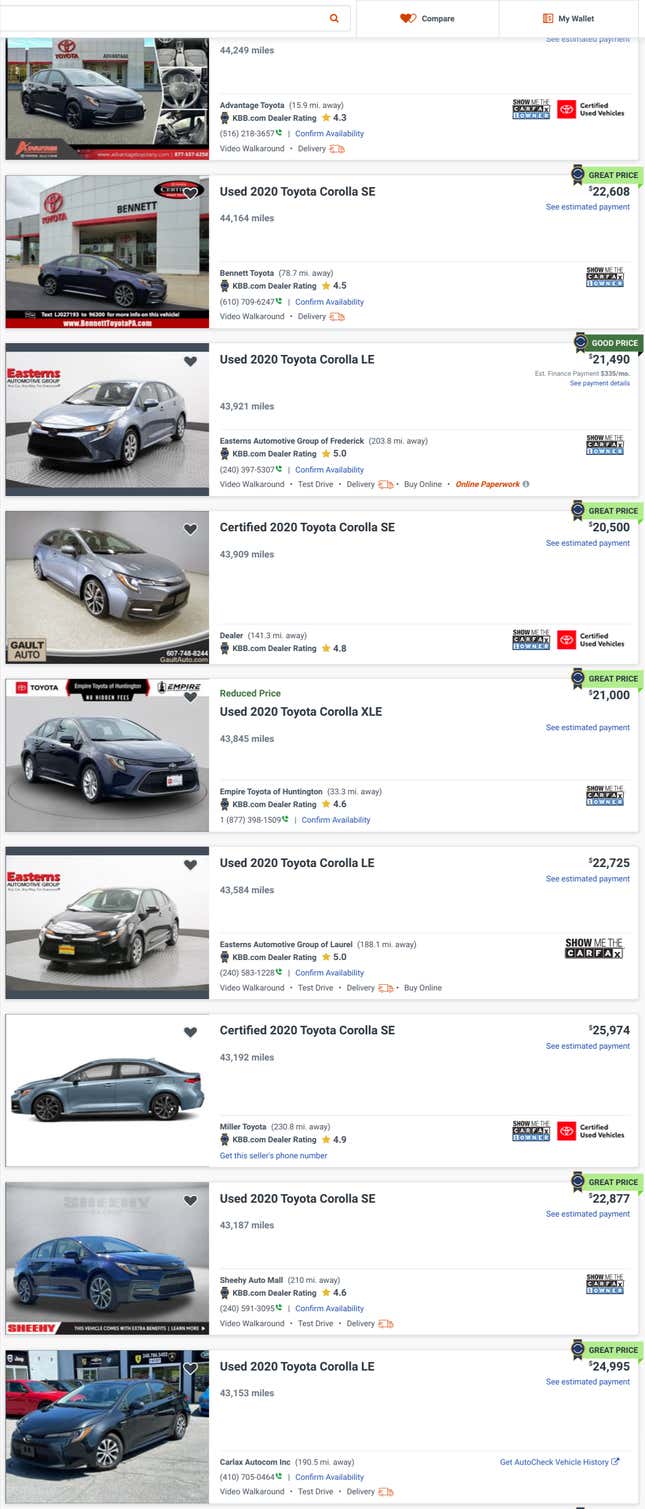

For instance, a fast scan of “gently used” Corollas within the NYC market with beneath 45,000 miles reveals costs within the low to mid $20,000 vary.

The MSRP on a brand-new Corolla LE is about $23,000. Some would possibly argue that I cherry-picked a automobile that has excessive resale to show some extent, however I selected the Corolla as a result of that’s precisely the kind of automobile that Orman and different “finance specialists” would advocate. Which is one thing easy, secure, dependable, and “reasonably priced.”

Orman additionally says that individuals ought to take out loans now not than three years, however let’s say somebody manages to attain a used Corolla for about $20,000 and has sufficient down cost to cowl the gross sales tax. At current rates of interest for used vehicles — about 6 p.c, assuming a top-tier credit score rating — somebody could be paying over $600 per 30 days … for a three-year-old Corolla.

What about EVs? Orman says that consumers may make the most of tax credit, and whereas some pre-owned EVs do qualify, sourcing a kind of “calmly used” electrical automobiles at an affordable value could be much more of a problem than an everyday previous Corolla.

Budgeting for a automobile buy shouldn’t be rocket science, however I by no means understood why so-called cash specialists by no means recommend taking a big-picture take a look at your funds by figuring out a cushty month-to-month cost after which working backward to see which vehicles would fall inside that value vary. There’s nothing inherently fallacious with taking out a 60 or perhaps a 72-month mortgage on a top quality automobile. However there’s a rational center floor between the $1,000 per 30 days funds on an enormous pickup and overpaying for a calmly used automobile.

Tom McParland is a contributing author for Jalopnik and runs AutomatchConsulting.com. He takes the trouble out of shopping for or leasing a automobile. Received a automobile shopping for query? Ship it to Tom@AutomatchConsulting.com